Sermon by Brandon Clements on March 26, 2023.

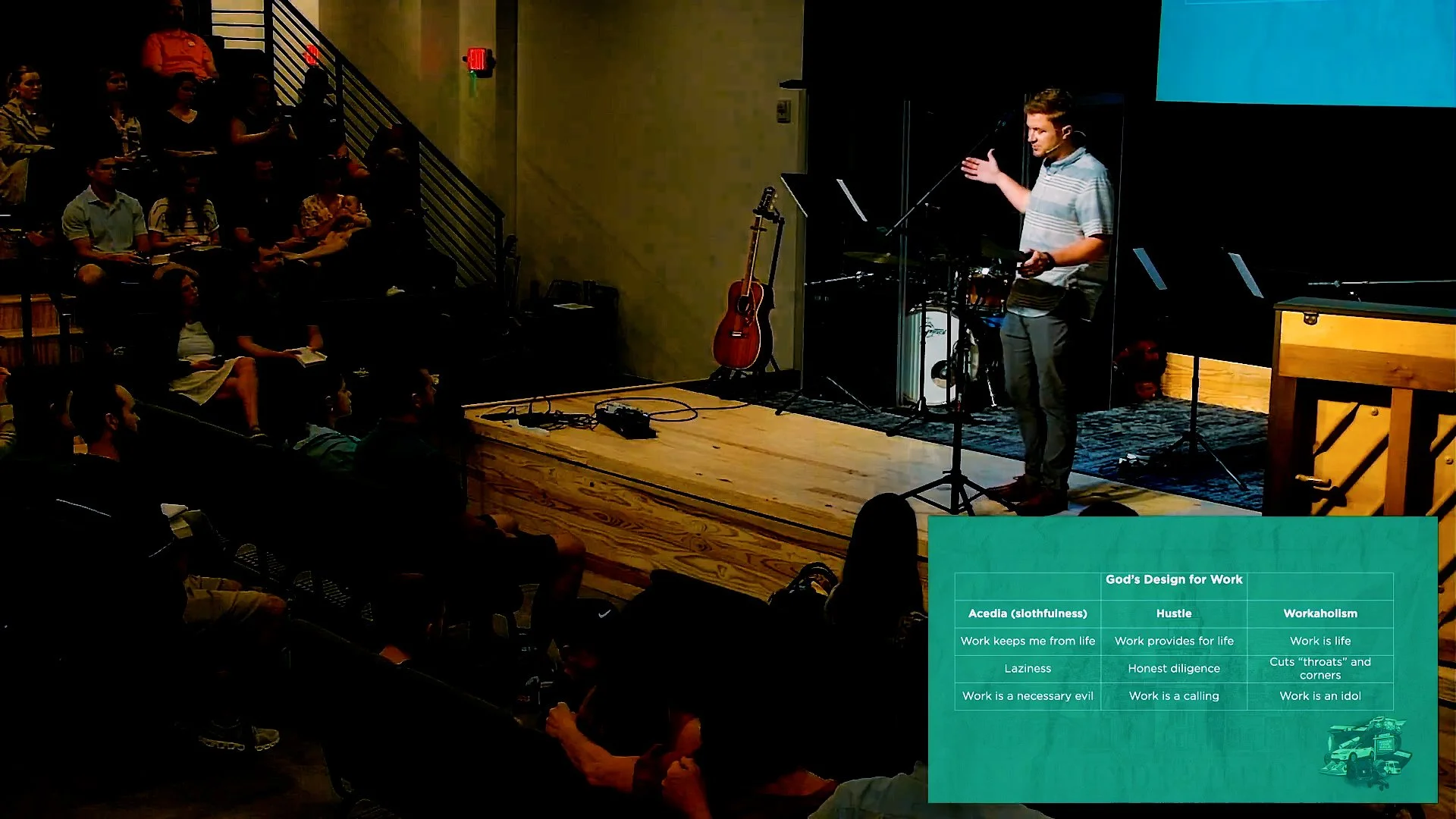

Last week we learned about the biblical vision behind our resources. Now, how does this help us shape our view of work? What are God’s purposes for you in your job? What does Jesus have to say in your 9-5, even when your job is less than ideal?

WEEK 4 HOMEWORK

This week you will be working on creating a budget. We have created a spreadsheet for you to create your budget. To access the spreadsheet:

Click the link below.

Once you open the link, click ‘File’ and ‘Make a Copy’ in the top left corner of the spreadsheet to create your copy.

If you already use a different tool for budgeting, feel free to use that during this time.

Step 1: Enter your monthly income

First, you will enter your monthly income. You only need to input numbers into the green cells in the file. As a reminder, if you have irregular income each month, you will need to figure out what your average monthly income is.

Step 2: Enter your monthly expenses

Below the income section, you will enter all your monthly expenses in the appropriate green cells. The cells in black will show you how much of your income you are putting towards a specific expense type. Feel free to change the names for the particular expense categories as it suits you.

As you budget, here are a few things to keep in mind. The Net number at the top of the spreadsheet must equal zero. If not, you are not finished. The goal is to allocate every dollar you are planning to receive for the coming month.

Next, always start with generosity. Scripture calls us to give our first fruits and our best to God. Start your budget with generosity and flow out from there. Finally, plan to meet your five basic needs first. Those are housing, utilities, food, transportation, and clothing.

Step 3: Budget using your financial goals

Once you have planned for these in your budget, use your financial goals from week 2 to help guide you. Do you need to save your first $1,000 or fully fund your emergency savings? Make that a priority. In the budget, there are lines for savings goals. Input what you can save each month to reach your goal. Even though you won’t be spending this money now, remember you are allocating every dollar in your budget to get your net to zero.

If you have emergency savings, are you trying to pay off any non-mortgage debt? After you meet your basic needs and have saved for an emergency, figure out how much you can put toward paying off your debts. Can you pay more than your minimum payments to get out of debt quicker? Is there spending happening beyond your basic needs that you can cut or trim down to help you achieve your financial goals?